tax shield formula dcf

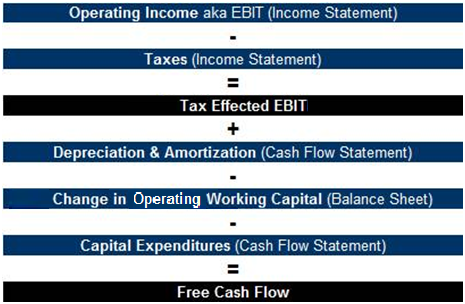

The formula for calculating the depreciation tax shield is as follows. The effect of a tax shield can be determined using a formula.

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

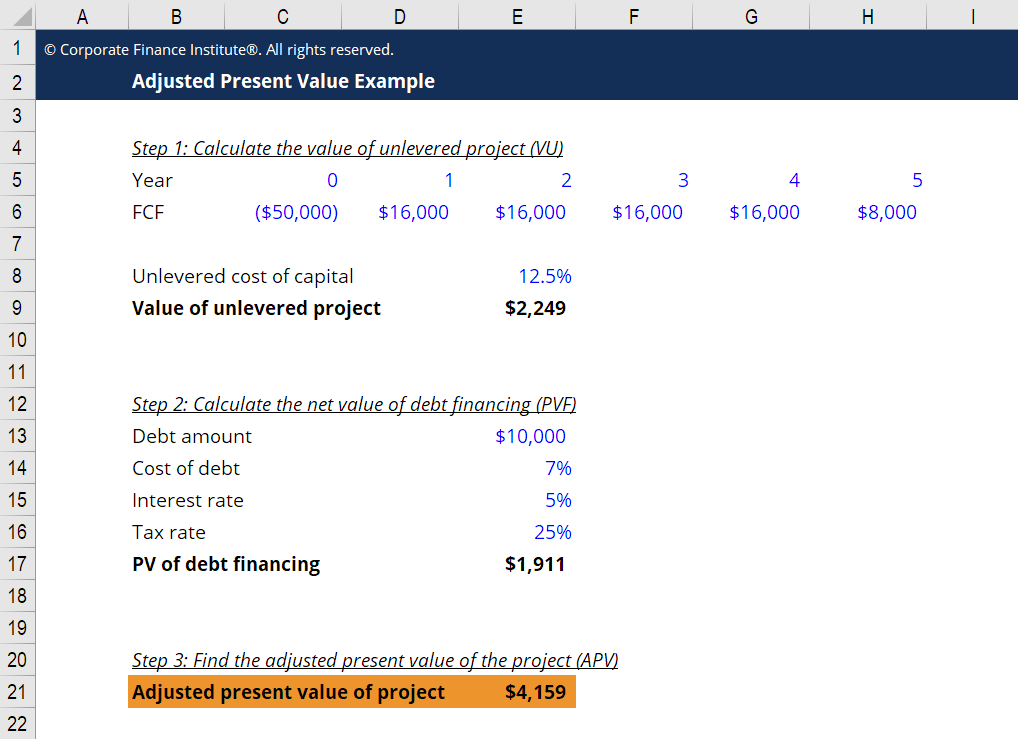

The present value of the interest tax shield is therefore calculated as.

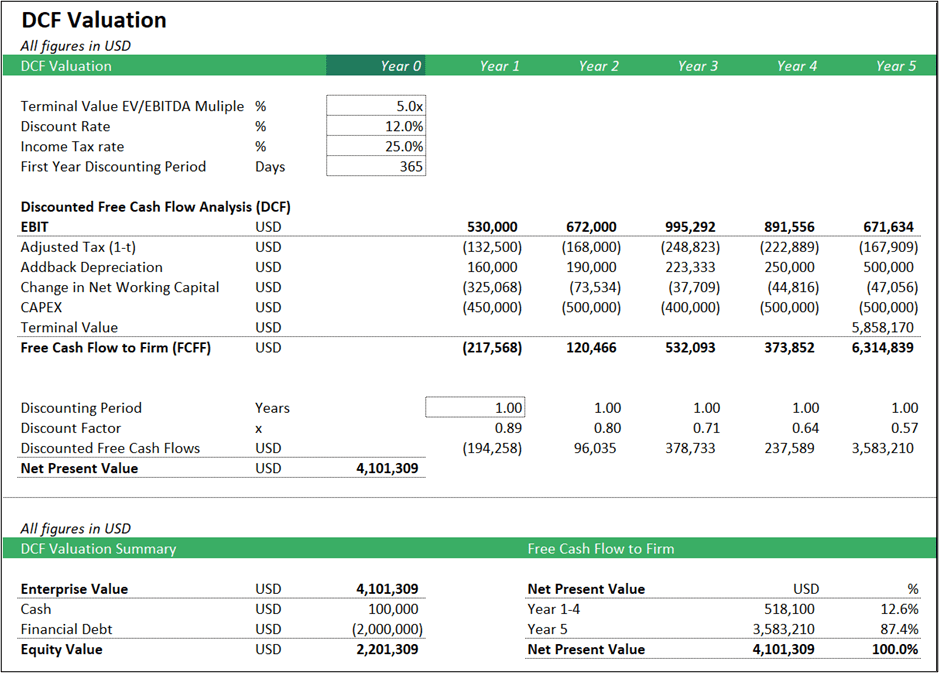

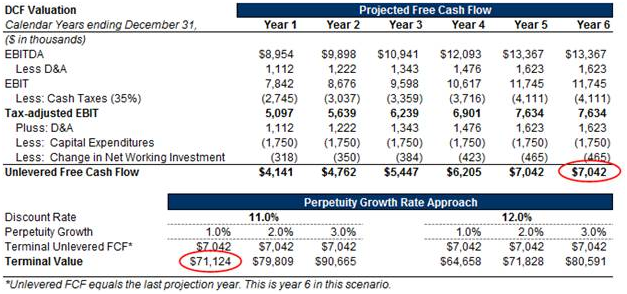

. There is no exact answer for. The DCF valuation of the business is simply equal to the sum of the discounted projected Free Cash Flow amounts plus the discounted Terminal Value amount. This is usually the deduction multiplied by the tax rate.

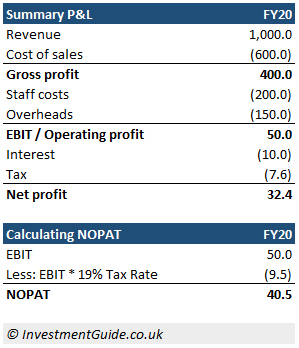

Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be. FCF EBIT 1-T DA - CAPEX - Change in working capital - Principal repayment - After tax interests New loans - Taxes. DCF INPUTS Value of Company X in dollars Value of Company X DCF in dollars DCF OUTPUT Company Value Shares of Stock Per Share Stock Price 5.

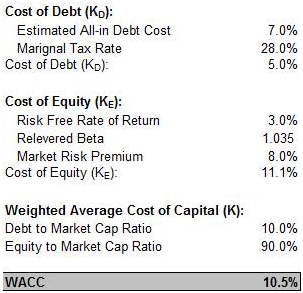

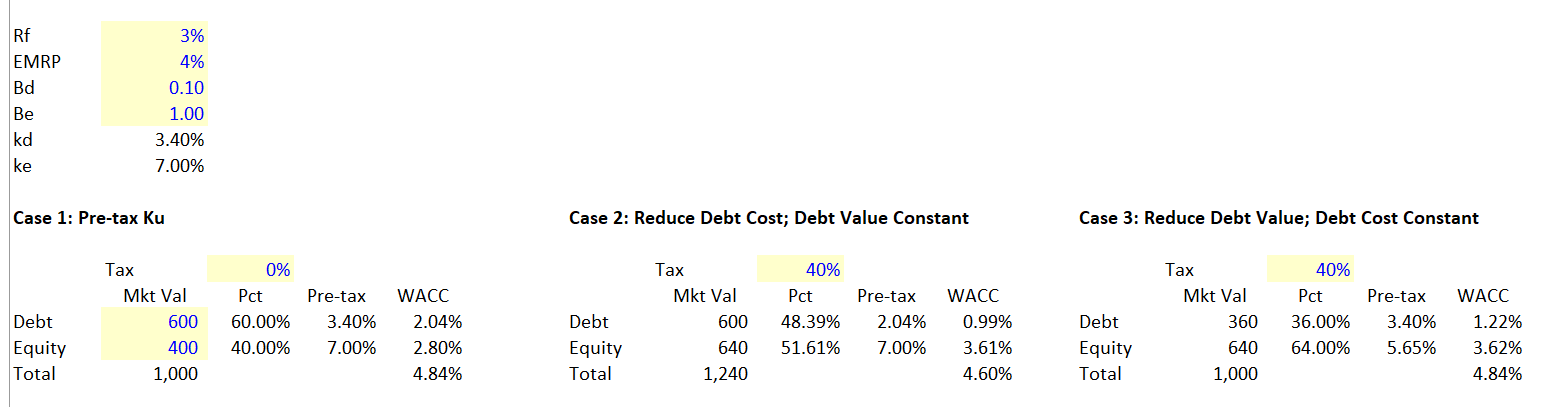

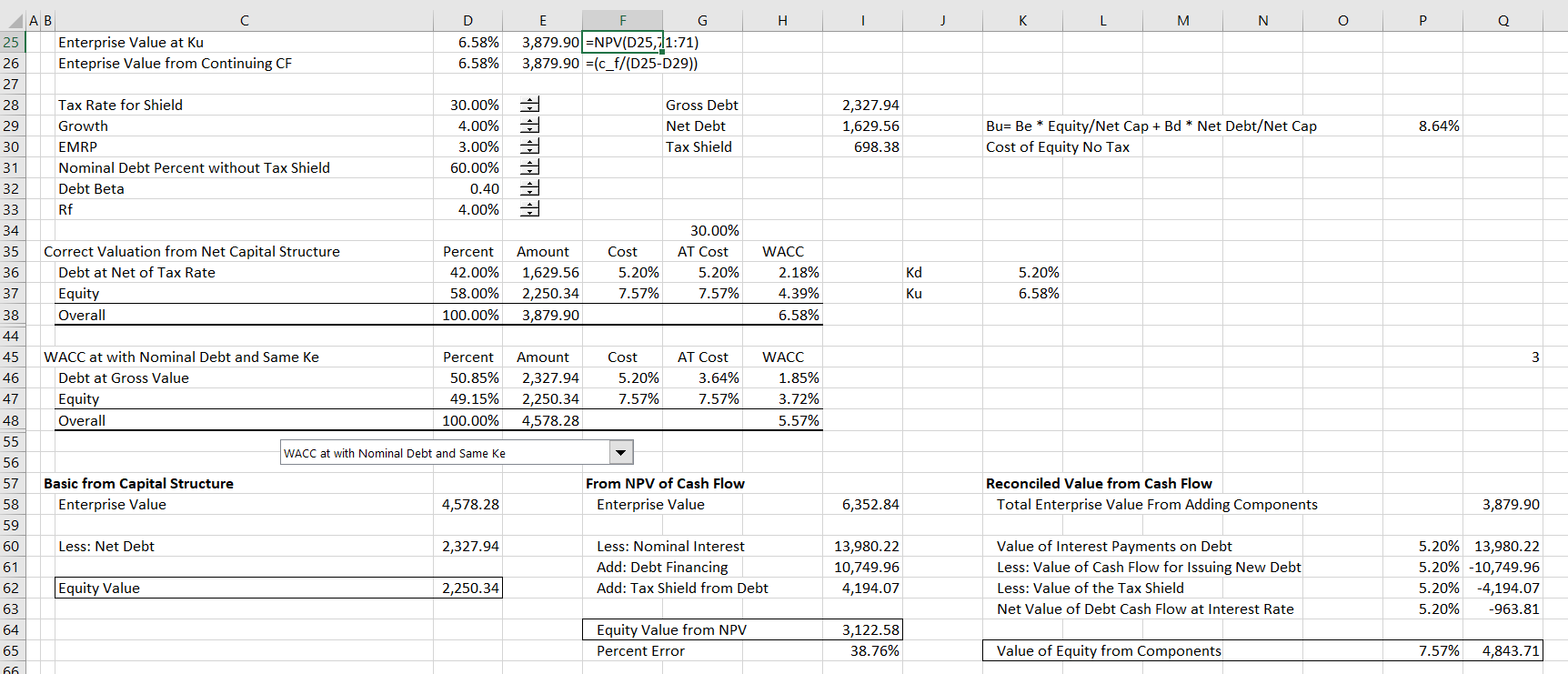

In short the Net Present Value of the Depreciation Tax Shield is 5 lower with the Sum-of-Years-Digits approach. Concerning DCF there are three widely used methods to calculate the present value of a company. Tax rate debt load interest rate interest rate.

Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the company has 1m of interest. The flows to equity method. And then discount it to the cost of equity.

For some calculations such as free cash flow putting back a tax shield can not be as straightforward as just adding the entire tax shields worth. Lets imagine that the entire Business is worth 1000. Tax Shield Deduction x Tax Rate.

The formula includes that comes. The standard WACC approach. Instead add the interest of.

The formula for calculating the interest tax shield is as follows. Further I can show a general expression for tax shields implementation wherein this well known WACC formula is only a special case.

Discounted Cash Flow Analysis Street Of Walls

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Discounted Cash Flow Dcf Valuation Investment Guide

Discounted Cash Flow Analysis Street Of Walls

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax Shield Formula How To Calculate Tax Shield With Example

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Discounted Cash Flow Analysis Street Of Walls

Using Apv A Better Tool For Valuing Operations

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Training Modular Financial Modeling Ii Dcf Valuations Enterprise Dcf Valuation Pre Tax Vs Post Tax Valuations Modano

Adjusted Present Value Apv Definition Explanation Examples

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Using Apv A Better Tool For Valuing Operations

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example